All Categories

Featured

Table of Contents

The rate is set by the insurer and can be anywhere from 25% to greater than 100%. (The insurance company can additionally transform the get involved rate over the lifetime of the policy.) If the gain is 6%, the participation rate is 50%, and the current cash money value total is $10,000, $300 is included to the cash value (6% x 50% x $10,000 = $300).

There are a variety of pros and cons to take into consideration prior to purchasing an IUL policy.: Just like typical universal life insurance coverage, the policyholder can boost their premiums or reduced them in times of hardship.: Quantities credited to the cash money value expand tax-deferred. The cash money value can pay the insurance policy costs, allowing the insurance policy holder to minimize or quit making out-of-pocket premium settlements.

Numerous IUL policies have a later maturation day than various other sorts of universal life policies, with some finishing when the insured reaches age 121 or more. If the insured is still to life during that time, policies pay out the survivor benefit (but not usually the money value) and the earnings might be taxable.

: Smaller sized policy face values don't provide much benefit over routine UL insurance policies.: If the index goes down, no rate of interest is credited to the cash worth.

With IUL, the objective is to benefit from upward activities in the index.: Because the insurance provider just acquires choices in an index, you're not straight invested in supplies, so you don't benefit when companies pay dividends to shareholders.: Insurers cost fees for handling your money, which can drain pipes cash worth.

Universal Life Insurance Agent

For most individuals, no, IUL isn't better than a 401(k) in regards to saving for retired life. The majority of IULs are best for high-net-worth people trying to find methods to lower their taxable earnings or those who have maxed out their other retired life choices. For everybody else, a 401(k) is a far better investment car since it does not bring the high costs and premiums of an IUL, plus there is no cap on the quantity you may gain (unlike with an IUL plan).

While you might not lose any type of money in the account if the index goes down, you won't make passion. If the market turns bullish, the incomes on your IUL will not be as high as a normal investment account. The high price of costs and fees makes IULs pricey and substantially less inexpensive than term life.

Indexed global life (IUL) insurance policy offers cash money worth plus a death advantage. The cash in the cash value account can gain interest with tracking an equity index, and with some often designated to a fixed-rate account. Indexed global life plans cap how much money you can accumulate (frequently at less than 100%) and they are based on a possibly volatile equity index.

Index Ul Vs Whole Life

A 401(k) is a far better alternative for that purpose because it doesn't lug the high costs and costs of an IUL plan, plus there is no cap on the quantity you may earn when invested. The majority of IUL policies are best for high-net-worth individuals looking for to reduce their gross income. Investopedia does not offer tax obligation, investment, or monetary solutions and suggestions.

An independent insurance policy broker can contrast all the options and do what's finest for you. When comparing IUL quotes from different insurance provider, it can be confusing and challenging to understand which option is best. An independent financial specialist can discuss the various features in plain English and recommend the most effective choice for your special scenario.

Equity Indexed Insurance

Rather of investigating all the different options, calling insurance business, and asking for quotes, they do all the job for you. Many insurance coverage representatives are able to conserve their clients money because they understand all the ins and outs of Indexed Universal Life strategies.

It's a reputable organization that was established in 1857 HQ lies in Milwaukee, offering for several years in economic services Among the largest insurance provider, with around 7.5% of the market share Has been offering its insurance holders for over 150 years. The company offers 2 kinds of offers that are term and permanent life plans.

For cyclists, the business likewise uses to complete their defense. For them, term life policies include chronic ailments, accelerated death benefits, and assured reimbursement choices. If you desire, you can add an insured term motorcyclist and a kid depending on the motorcyclist to cover the entire household. For a Common of Omaha life-indexed insurance coverage plan, you require to have a quote or connect with a licensed agent.

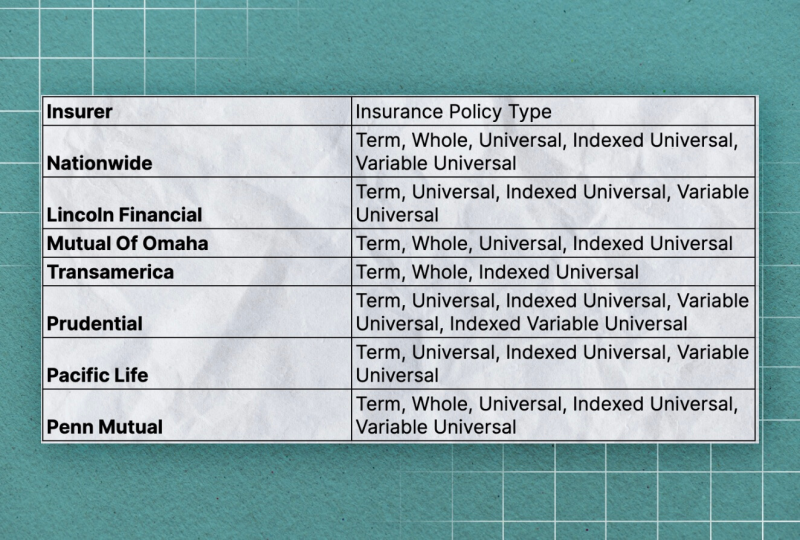

Penn Mutual provides life insurance policy policies with numerous benefits that match individuals's requirements, like individuals's investment objectives, economic markets, and budget plans. One more company that is renowned for providing index global life insurance coverage policies is Nationwide.

What Is A Guaranteed Universal Life Insurance Policy

The head office of the company lies in Columbus, Ohio. The business's insurance plan's durability is 10 to three decades, together with the supplied insurance coverage to age 95. Term policies of the companies can be converted into permanent plans for age 65 and eco-friendly. The firm's global life insurance plans use tax-free survivor benefit, tax-deferred incomes, and the versatility to readjust your costs payments.

You can additionally use kids's term insurance coverage and lasting care protection. If you are looking for among the leading life insurance policy companies, Pacific Life is a great option. The firm has actually frequently been on the leading list of leading IUL companies for years in terms of selling products given that the company developed its very first indexed universal life products.

What's excellent concerning Lincoln Financial contrasted to other IUL insurer is that you can likewise transform term policies to global plans offered your age is not over 70. Principal Financial insurer supplies solutions to around 17 countries throughout worldwide markets. The business offers term and universal life insurance policy policies in all 50 states.

Variable universal life insurance can be thought about for those still looking for a much better choice. The money value of an Indexed Universal Life plan can be accessed with plan lendings or withdrawals. Withdrawals will minimize the fatality benefit, and fundings will certainly accrue interest, which need to be paid back to keep the plan in force.

Accumulation At Interest Option

This policy design is for the consumer that requires life insurance coverage but would love to have the ability to select just how their cash money worth is invested. Variable plans are underwritten by National Life and distributed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Policy Company, One National Life Drive, Montpelier, Vermont 05604.

The details and summaries had below are not planned to be full summaries of all terms, conditions and exclusions applicable to the items and services. The exact insurance protection under any type of nation Investors insurance coverage product is subject to the terms, conditions and exclusions in the real policies as released. Products and solutions explained in this internet site differ from state to state and not all products, protections or solutions are offered in all states.

In case you pick not to do so, you need to think about whether the product concerned is suitable for you. This information brochure is not a contract of insurance coverage. Please describe the plan contract for the specific terms, particular information and exemptions. The policy discussed in this details brochure are protected under the Policy Owners' Security Scheme which is carried out by the Singapore Deposit Insurance Company (SDIC).

For more details on the kinds of advantages that are covered under the scheme along with the limitations of insurance coverage, where relevant, please contact us or go to the Life Insurance Association, Singapore or SDIC websites () or (www.sdic.org.sg). This advertisement has not been examined by the Monetary Authority of Singapore.

Table of Contents

Latest Posts

Indexed Whole Life Insurance Policy

Best Iul

Indexed Universal Life Good Or Bad

More

Latest Posts

Indexed Whole Life Insurance Policy

Best Iul

Indexed Universal Life Good Or Bad